What you need to know

Learn about your super responsibilities as a business owner. We have provided you with important information you need to know about super and your business.

Learn about your super responsibilities as a business owner. We have provided you with important information you need to know about super and your business.

The Super Guarantee (SG) is a compulsory contribution which all employers need to make on behalf of each of their eligible employees.

Employer contributions are paid directly to each employee's nominated or existing super fund, or a default fund, on their behalf.

Refer to the ‘Offering your employee’s choice’ and ‘Paying SG contributions’ sections for more on your requirements to pay your employees super.

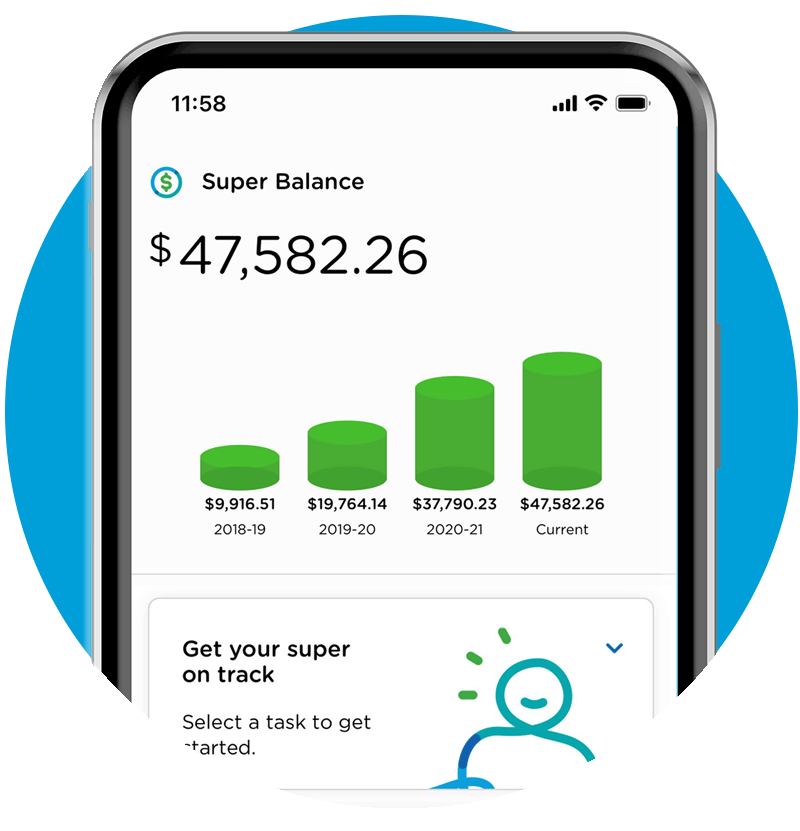

Super is one of the biggest financial investments your employees will ever have. It’s money saved throughout their working life and invested so they’ll be better off when they retire. That’s why the Super Guarantee was legislated – to help Australians with saving for their future retirement by setting the minimum amount of superannuation employers must pay to eligible employees

All eligible workers aged 18 years or older are entitled to receive SG contributions regardless of how much they earn. Workers under the age of 18 are only eligible for SG contributions if they work more than 30 hours per week. For more information visit the ATO website.

Rest members can choose from a diverse range of investment options which gives them the option to have more control over how their money is invested.

Our investment options include a mix of asset classes such as shares, property, bonds and cash, with varying levels of potential risk and return to suit member needs. If members don’t make a choice of option, we'll invest their super in our MySuper product – Core Strategy.

Learn more about how Rest invests here.

As a business owner we know your priority is ensuring your business’s success and profitability. Paying yourself super is generally placed at the bottom of the list which means many business owners neglect their own super.

Super for business owners is just as important as super for your employees. Compliant superannuation payments may be eligible to be taxed at a lower rate than your marginal rate and count towards your savings pool to help you achieve your retirement goals.

A default fund is the super fund that you pay an employee's super contributions into if they don’t nominate their own fund or have a stapled fund (an employee’s existing super fund that is ‘stapled’ to them for the duration of their career, unless they choose another fund).

By law, all employers must select a default super fund that offers a MySuper product. Employers are required to pay all contributions made for employees who have not exercised choice of fund and do not have a stapled fund to the selected default fund. These default superannuation contributions will be invested in the MySuper product of the default fund.

MySuper is a type of super product designed to have simple features and low-cost. These products were introduced by the Government to help employers compare MySuper products more easily irrespective of which fund provides them based on a few key features. Rest’s MySuper product is called Core Strategy.

The default super fund that you choose must be:

If you are interested in choosing Rest as your default fund, you can speak to a business specialist about how Rest can help your business.

Industrial awards set the minimum standards that an employer must pay their employees within an industry, which also applies to their choice of super fund.

Before selecting a default fund, check if you are under any state award or industrial agreement as your super fund may already be nominated for you.

You can see if your industry is part of an award on the Fair Work Commission website.

As an employer, it is important to note that the privacy rules covering all personal information held by organisations regulate, among other matters, the way organisations collect, use, disclose, keep secure and give people access to personal information.

In some cases, you may be required to provide Rest with personal information about your employees to enable us to administer their accounts.

All information provided to Rest is treated in accordance with our Privacy Policy as outlined on our website. It is also important that you advise your employees where you are required to provide us with their personal information.

Choice of Fund legislation allows eligible employees to choose which super fund their contributions are paid into. However, if they don’t make a choice you are required to undertake a stapled fund search using the tool on the ATO’s website. If there is no stapled fund and your employee has not made a choice, you can then pay the SG contributions into your default fund. Learn more about Super Stapling here.

As an employer, you are responsible for identifying which employees are eligible for choice based on their employment circumstances and offering them a choice of fund using the Standard Choice Form.

As an employer you are responsible for identifying which employees are eligible to choose their fund.

Employees can generally choose their super fund if they are:

Employees may not be eligible to choose a super fund if:

For those employees who are eligible, you must provide a Standard Choice of Fund Nomination form to them within 28 days of their start date. If they do not provide their fund details, you must conduct a stapled fund search using the ATO tool, and if no fund is found, you can pay their contributions into your default fund.

You can find additional resources to use during the onboarding process to help your employees learn about super here.

As an employer, you must pay a minimum of 11% of each eligible employee's ordinary time earnings (usually the amount your employee earns for their ordinary hours of work) each quarter.

If your employees are covered by an award or employment agreement which specifies a higher super contribution than 11%, you must pay that higher amount.

These payments may be claimed as a tax deduction. This minimum percentage is projected to gradually go up to 12% by 1 July 2025.

| The SG rate | ||

|---|---|---|

| 1 July 2023 -30 June 2024 | 11.0% | |

| 1 July 2024 -30 June 2025 | 11.5% | |

| From 1 July 2025 | 12.0% |

| The SG rate | 1 July 2023 -30 June 2024 |

| 11.0% | |

| The SG rate | 1 July 2024 -30 June 2025 |

| 11.5% | |

| The SG rate | From 1 July 2025 |

| 12.0% | |

Rest recommends making monthly payments. Employers that aren’t required to contribute on a monthly basis under an award or industrial agreement can choose to make quarterly contributions. The SG deadline date is set 28 days after the end of each quarter:

| Period | SG payment due date | |

|---|---|---|

| 1 July – 30 September | 28 October | |

| 1 October – 31 December | 28 January | |

| 1 January – 31 March | 28 April | |

| 1 April – 30 June | 28 July |

| Period | 1 July – 30 September |

| SG payment due date | 28 October |

| Period | 1 October – 31 December |

| SG payment due date | 28 January |

| Period | 1 January – 31 March |

| SG payment due date | 28 April |

| Period | 1 April – 30 June |

| SG payment due date | 28 July |

Failure to pay super can result in the ATO applying a penalty known as the SG charge. It may include the SG shortfall, interest and an administration fee which is not tax deductible and will result in an added expense to your business.

If you are a Rest employer, you can pay super online through one of the following online methods:

Supported by Rest:

Alternative options:

* SCH-Online is operated by The Superannuation Clearing House Pty Limited (ABN 15 086 576 721), a corporate authorised representative (representative number 290290) of the product issuer, Pacific Custodians Pty Limited (ABN 66 009 682 866), Australian Financial Services License No. 295142.

Rest does not issue or arrange the issue of SCH Online products and/or services. Rest does not recommend, endorse or express an opinion about SCH Online. As such, Rest does not accept liability for any loss or damage you incur in connection with your reliance on SCH Online. Rest does not receive any commissions or other benefits from Pacific Custodians Pty Limited as a result of your use of SCH Online.

A clearing house allows you to pay all your employees at the same time, no matter which fund they are with. Generally, the employer makes one bulk payment to the clearing house and then the clearing house distributes the required payments to your employees’ super funds on your behalf.

Using a clearing house may not be appropriate in all circumstances. You should consider your options based on your circumstances and also the relevant product disclosure statement before making a decision.

The government requires employers to keep records of:

Generally records must be kept for at least 5 years and written in English or can be easily accessed and converted into English.

No matter the size of your business. Rest has options to support you and you employees.

We have made it easier than ever for you to feel confident your business is up to date with your super requirements.